The Financial Landscape of 2025: AI Revolution, Crypto Evolution, and Sustainable Growth

Introduction

The financial sector is undergoing a profound transformation in 2025, driven by technological innovation, changing market dynamics, and evolving consumer preferences. Three key trends stand at the forefront of this revolution: artificial intelligence's deep integration into financial systems, cryptocurrency's continued market evolution, and the dramatic rise of sustainable finance. This article explores these transformative forces reshaping the global financial landscape and their implications for investors, institutions, and consumers alike.

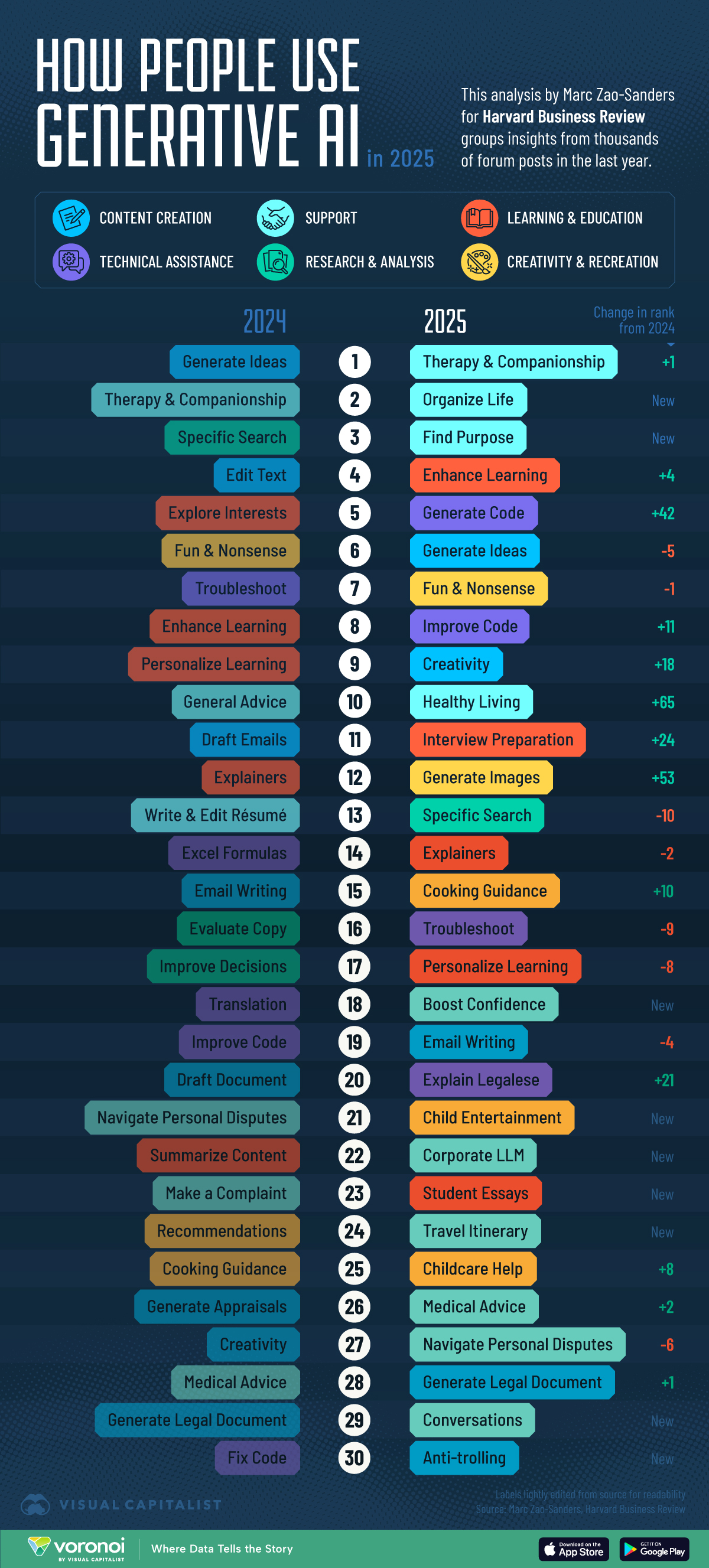

The AI Revolution in Finance

Artificial intelligence has moved from an experimental technology to a fundamental component of financial operations in 2025. According to the World Economic Forum's recent insights, AI is both transforming business operations and creating new challenges that require strategic responses. World Economic Forum

AI-Powered Financial Operations

In 2025, AI finance tools have reached unprecedented levels of efficiency, processing invoices, reconciling accounts, and inputting data with near-perfect accuracy. AI-powered robotic process automation (RPA) tools enable real-time processing of thousands of transactions simultaneously, dramatically reducing human error while increasing operational speed. Workday Blog

Key AI Finance Trends in 2025:

Enhanced Risk Management: AI systems now enable better data utilization for risk assessment, helping financial institutions identify potential issues before they escalate into crises.

Intelligent Credit Assessment: Machine learning algorithms analyze thousands of data points to make more accurate lending decisions in seconds, expanding credit access while reducing default rates.

Real-time Fraud Detection: Advanced AI systems identify suspicious patterns across millions of transactions in milliseconds, protecting both institutions and consumers from fraudulent activities.

Predictive Financial Planning: AI tools provide personalized financial advice based on spending habits, market conditions, and long-term goals, democratizing financial planning services.

According to Morgan Stanley's 2025 insights, technology companies are now focused on building AI platforms that optimize performance for their enterprise customers, marking a strategic shift from experimentation to implementation. Morgan Stanley

BCG's latest survey reveals that AI remains a top priority for business leaders worldwide in 2025, with a strong focus on generating tangible results rather than merely exploring possibilities. The AI industry is projected to increase in value by over 5x over the next five years, with the US AI market forecast to reach $299.64 billion by 2026. BCG

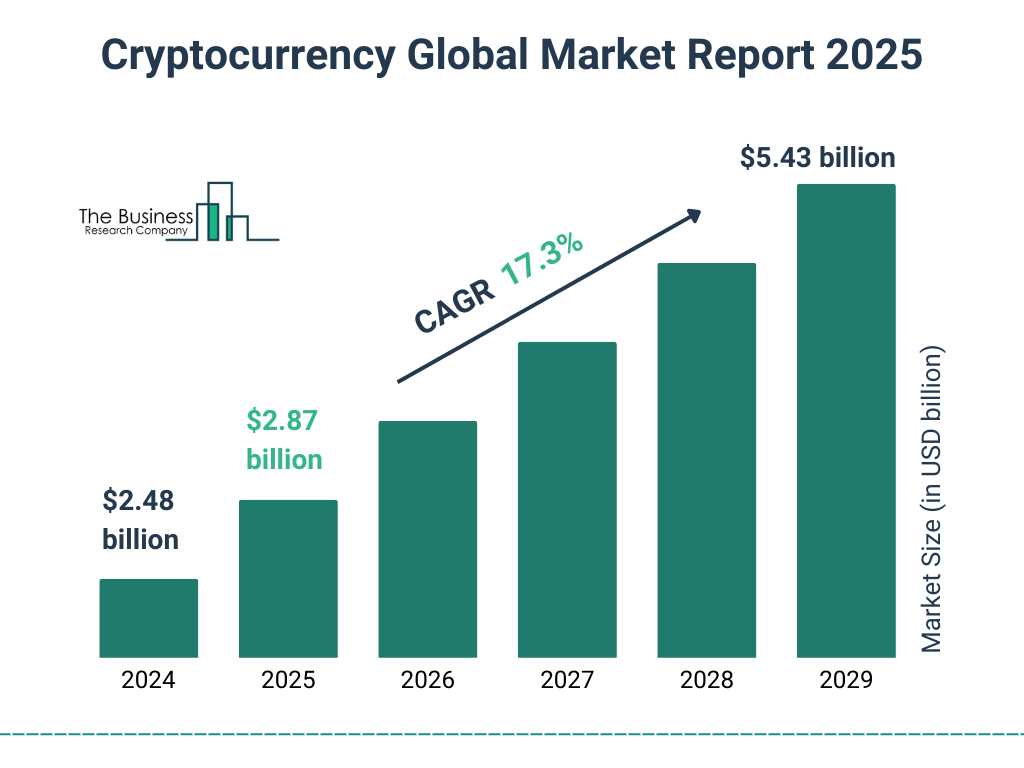

Cryptocurrency Market in 2025: Stabilization Amid Volatility

The cryptocurrency landscape has entered a new phase of development and maturation in 2025, characterized by institutional adoption, regulatory clarity, and technological advancement.

Market Performance and Trends

After a turbulent start to 2025, the cryptocurrency market has shown remarkable resilience. Total crypto market capitalization experienced an 18.6% decline in Q1, closing at $2.8 trillion after briefly touching $3.8 trillion in January. However, recent trends suggest a recovery is underway, with Bitcoin reclaiming the $90,000 level in late April for the first time since March. CoinGecko

Key developments in the cryptocurrency space include:

Institutional Integration: More traditional financial institutions now maintain dedicated crypto trading desks, custody solutions, and blockchain pilot programs, signaling mainstream acceptance.

Bitcoin's Continued Dominance: Despite price fluctuations, Bitcoin started 2025 by surpassing the historic $100,000 milestone, driven largely by U.S. spot Bitcoin exchange-traded funds (ETFs).

Maturing Market Structure: The cryptocurrency trading ecosystem has evolved significantly, with range-bound volatility dropping to more sustainable levels in 2025.

Regulatory Framework Development: Clearer regulatory guidelines are emerging globally, providing investors with greater certainty while maintaining innovation.

According to Nasdaq's analysis, moderate Bitcoin growth and price appreciation are expected in mid- to late 2025, tied to stablecoin and DeFi growth. Nasdaq

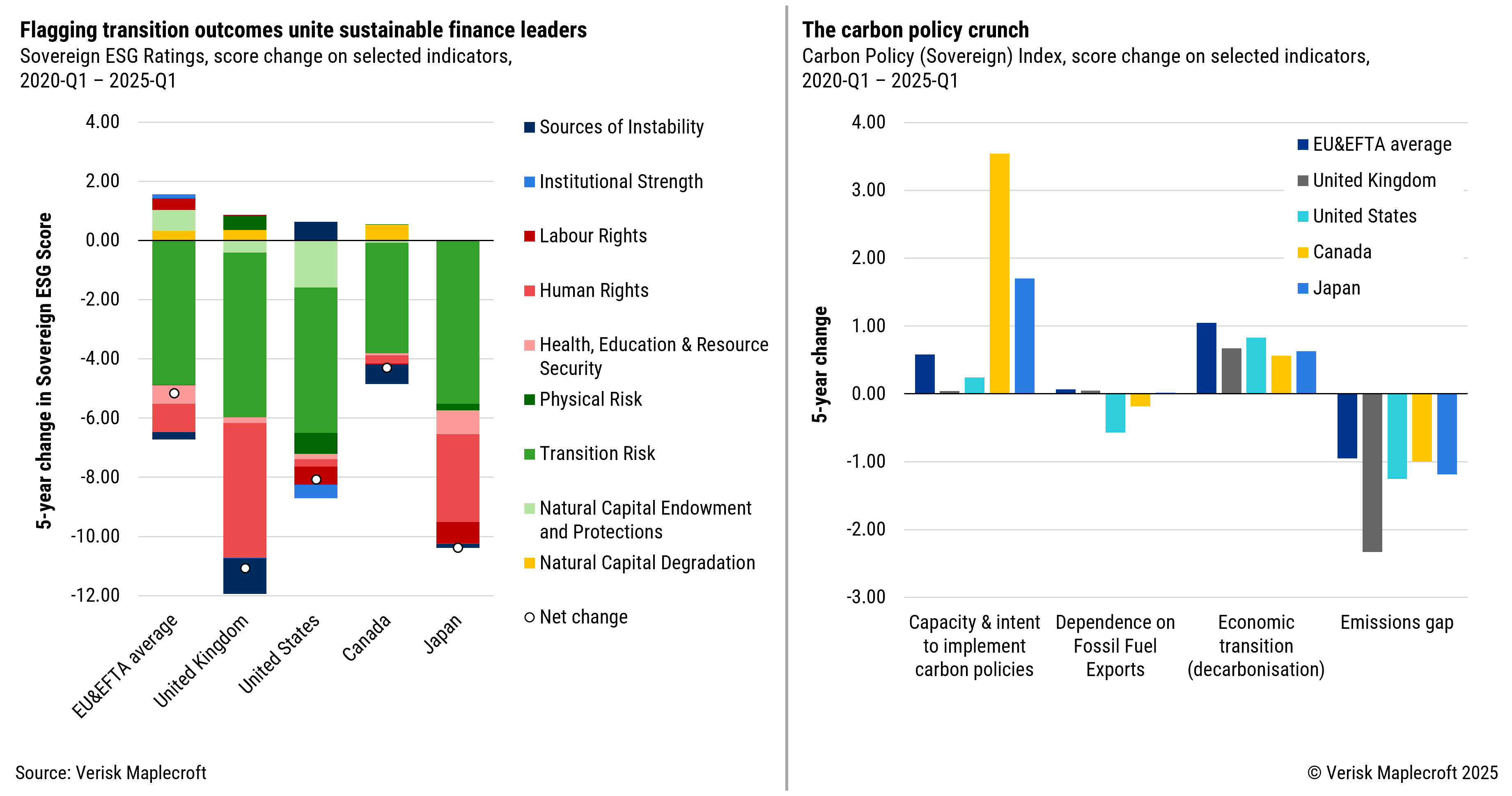

The Rise of Sustainable Finance

Sustainable finance has moved from niche to mainstream in 2025, with environmental, social, and governance (ESG) considerations becoming fundamental to investment decisions across the financial ecosystem.

Sustainable Finance Growth and Impact

The sustainable finance sector is expanding at a remarkable pace, with global ESG assets under management projected to reach US$34 trillion by 2026. This reflects an increasing recognition of both the financial and ethical imperatives to align investments with sustainability goals. Sustainability Magazine

J.P. Morgan's Q1 2025 Decarbonization & Sustainability Trends report highlights that global climate policy and sustainable finance are entering a pivotal phase in 2025, with major shifts in U.S. climate policy reshaping international approaches to sustainable investment. J.P. Morgan

Key Sustainable Finance Developments:

Nature-Positive Finance: 2025 is witnessing accelerated growth in nature-based financial solutions that protect biodiversity while generating returns.

Climate Finance Targets: The global community is working toward a $300 billion climate finance target through bilateral arrangements, multilateral development banks, and private sector investments.

Record Green Bond Issuance: Sustainable bond markets have reached record levels, with green bonds leading the charge in capital mobilization for environmental projects.

Regional Leadership: North America saw sustainable bond issuance volume total $124 billion in 2024, 1% higher than the previous year, according to Moody's Ratings. Global Finance Magazine

Convergence of Trends: The Integrated Future of Finance

The intersection of AI, cryptocurrency, and sustainable finance is creating powerful new financial paradigms that are both technologically advanced and purpose-driven.

AI-Powered Sustainable Investment

Machine learning algorithms now analyze vast datasets to identify companies with strong ESG performance, helping investors align their portfolios with sustainability goals while maintaining competitive returns. These AI systems can detect greenwashing by comparing corporate sustainability claims against actual performance metrics.

Blockchain for ESG Verification

Cryptocurrency technologies, particularly blockchain, are being deployed to verify sustainable supply chains, carbon offsets, and impact investing outcomes. This creates unprecedented transparency in ESG claims and allows for more effective allocation of sustainability-focused capital.

Democratized Financial Access

The combined effect of these technologies is democratizing access to sophisticated financial services. AI-powered robo-advisors now offer ESG-focused investment strategies at minimal costs, while cryptocurrency platforms enable micro-investments in sustainable projects globally.

Conclusion

The financial landscape of 2025 stands at a fascinating inflection point where cutting-edge technology meets evolving social consciousness. AI is transforming operational efficiency and decision-making across the financial sector. Cryptocurrencies continue their journey toward mainstream adoption while navigating volatility. Sustainable finance is rapidly becoming a central consideration rather than a peripheral concern.

For investors, institutions, and consumers, these converging trends create both challenges and opportunities. Those who can successfully navigate this new terrain—embracing technological innovation while remaining aligned with sustainability principles—will likely find themselves well-positioned in the financial world of tomorrow.

As we move further into 2025, the financial ecosystem will continue to evolve rapidly. The organizations and individuals who thrive will be those who maintain adaptability, technological fluency, and a clear vision of how finance can serve both profit and purpose in an increasingly complex world.